|

Expenses from Your Profession

Claiming Job Application Costs on Your Tax Return

|

Glossary of Tax Terms

Informing the Tax Office about Inheritances & Valuable Gifts

|

Expenses from Your Profession

How to Deduct Business Trips from Your Taxes

|

Submitting Your Tax Return

How to File a Joint Tax Return with Your Spouse

|

Submitting Your Tax Return

Individual Tax Returns for Married Couples

|

Glossary of Tax Terms

Church Tax on Your Tax Return

|

Expenses from Your Profession

How to Deduct Your Computer & Receive Tax Savings

|

Expenses from Your Profession

Claim Costs for Further Education on Your Tax Return

|

Glossary of Tax Terms

How Can I Save Taxes from My Utility Bill?

|

Glossary of Tax Terms

Tax return: Lump sum for exercise leaders (Übungsleiterpauschale)

|

Expenses from Your Profession

Income-Related Expenses (Werbungskosten)

|

Submitting Your Tax Return

How the Corona Virus Affects Your Tax Return

|

Glossary of Tax Terms

File Your Tax Return Electronically with Wundertax

|

Short-Term Work (Kurzarbeit): A to Z

Short-Term Work – Info for Employers

|

Glossary of Tax Terms

Save Taxes with the Saver's Allowance

|

Glossary of Tax Terms

Withholding Tax (Abgeltungsteuer) on Capital Gains: All You Need to Know

|

Glossary of Tax Terms

ELStAM - What Does It Mean?

|

Glossary of Tax Terms

One-Fifth Method (Fünftelregelung) – Tax Savings!

|

Short-Term Work (Kurzarbeit): A to Z

Short-Term Work Benefits – What You Need to Know!

|

Glossary of Tax Terms

Your eTIN Number

|

Glossary of Tax Terms

Tax Reduction for Tradespeople Expenses: How to

|

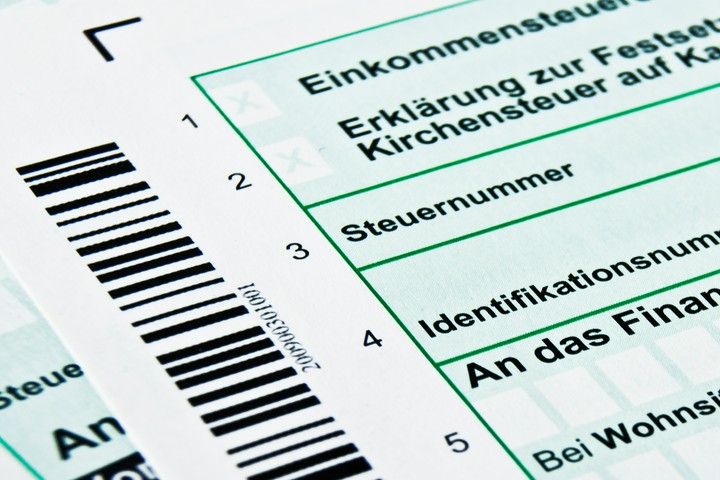

Submitting Your Tax Return

Tax ID and Tax Number: Everything You Need to Know!

|

Short-Term Work (Kurzarbeit): A to Z

BAföG and Short-Term Work

|

Glossary of Tax Terms

Tax Deductible Donations (Spenden)

|

Short-Term Work (Kurzarbeit): A to Z

Pensions (Rente) in Corona Times

|

Short-Term Work (Kurzarbeit): A to Z

Glossary for Short-Term Work & Taxes

|

Short-Term Work (Kurzarbeit): A to Z

110 Years of Short-Term Work

|

Submitting Your Tax Return

Tax Forms for Your 2020 Tax Return

|

Short-Term Work (Kurzarbeit): A to Z

Progressionsvorbehalt: How It Changes Your Tax Rate

|

Expenses from Your Profession

Do Tips Have to Be Taxed? (Trinkgeld versteuern)

|

Submitting Your Tax Return

This is how you apply for a tax number (Steuernummer)

|

Glossary of Tax Terms

Who has to pay business tax and when is it due? (Gewerbesteuer)

|

Tax Assessment Notice

How do I file an appeal against the tax notice? (Einspruch gegen Steuerbescheid einlegen)

|

Expenses from Your Profession

Request for simple change: When Mistakes are on Your Tax Return

|

Expenses from Your Profession

How do I deduct my moving costs from my taxes? (Umzugskosten)

|

Tax Assessment Notice

When will I get my tax refund from the tax office? (Steuerrückzahlung)

|

Tax Assessment Notice

How to read your tax assessment notice (Steuerbescheid Aufbau)

|

Glossary of Tax Terms

How to deduct household services from your taxes (Haushaltsnahe Dienstleistungen)

|

Glossary of Tax Terms

What is the beneficial tax check? (Günstigerprüfung)

|

Submitting Your Tax Return

If I file my tax return once, do I always have to?

|

Expenses from Your Profession

How to claim meals from business trips on your tax return (Verpflegungsmehraufwand)

|

Glossary of Tax Terms

What is an Employee Savings Allowance? (Arbeitnehmersparzulage)

|

Deductible Expenses for Parents

What Is A Relief For Single Parents? (Entlastungsbetrag Alleinerziehender)

|

Glossary of Tax Terms

These are the most important flat-rates (Pauschalen in der Steuererklärung)