What is a German annual payslip (Lohnsteuerbescheinigung)?

Annual payslips in Germany are issued once a year and summarize information about your salary, your paid wage tax, and social security contributions. Employees and civil servants receive these from their employer at the end of February of the following year at the latest. Employers also transmit your annual payslip to the tax office.

INDEX

-

What is an annual payslip in Germany?

-

When will I receive my annual payslip?

-

What do I need the annual payslip for?

-

Which information does an annual payslip in Germany include?

-

What to do in case of incorrect data?

-

Should I hang on to my Lohnsteuerbescheinigungen?

-

Lost your annual payslip?

What is an annual payslip in Germany?

As an employee or civil servant, you receive a monthly pay slip (Gehaltsabrechnung) containing information about your

- taxable salary,

- your paid wage tax (Lohnsteuer),

- and, if applicable, solidarity surcharges (Solidaritätszuschlag) and church tax (Kirchensteuer).

Employees also pay compulsory social security contributions. This information is summed up once per calendar year in an annual payslip called ‘Lohnsteuerbescheinigung’.

When will I receive my annual payslip?

Your employer is required to transmit your annual payslip to your local tax office by the end of February following a given calendar year at the absolute latest. In addition, you must be provided with a digital or print out version of your annual payslip.

If your employment is terminated within the calendar year, you will receive your annual payslip earlier and if you were employed by multiple companies throughout the year, you will receive multiple certificates.

Note: If you employ someone within the scope of a minijob (geringfügige Beschäftigung) in your private household, you can submit to the tax office instead of the electronic annual payslip a paper certificate according to the officially prescribed pattern.

What do I need the annual payslip for?

Your annual payslip is an important document that provides information on how much wage tax you’ve actually paid in the last calendar year, it is also the basis of your income tax return. It is evidence of the actual withholding of wage tax, not of the wage tax withholding as it should have been. As your employer provides the tax authorities with your electronic wage tax statement data (referred to as eDaten), you no longer have to enter it in Form N of your tax return - unless you suspect the data either was not transmitted or is incorrect.

You can also use the annual payslip as proof of earnings (Verdienstnachweis) when applying for parental benefits (Elterngeld) or for your child’s BAFöG-Antrag.

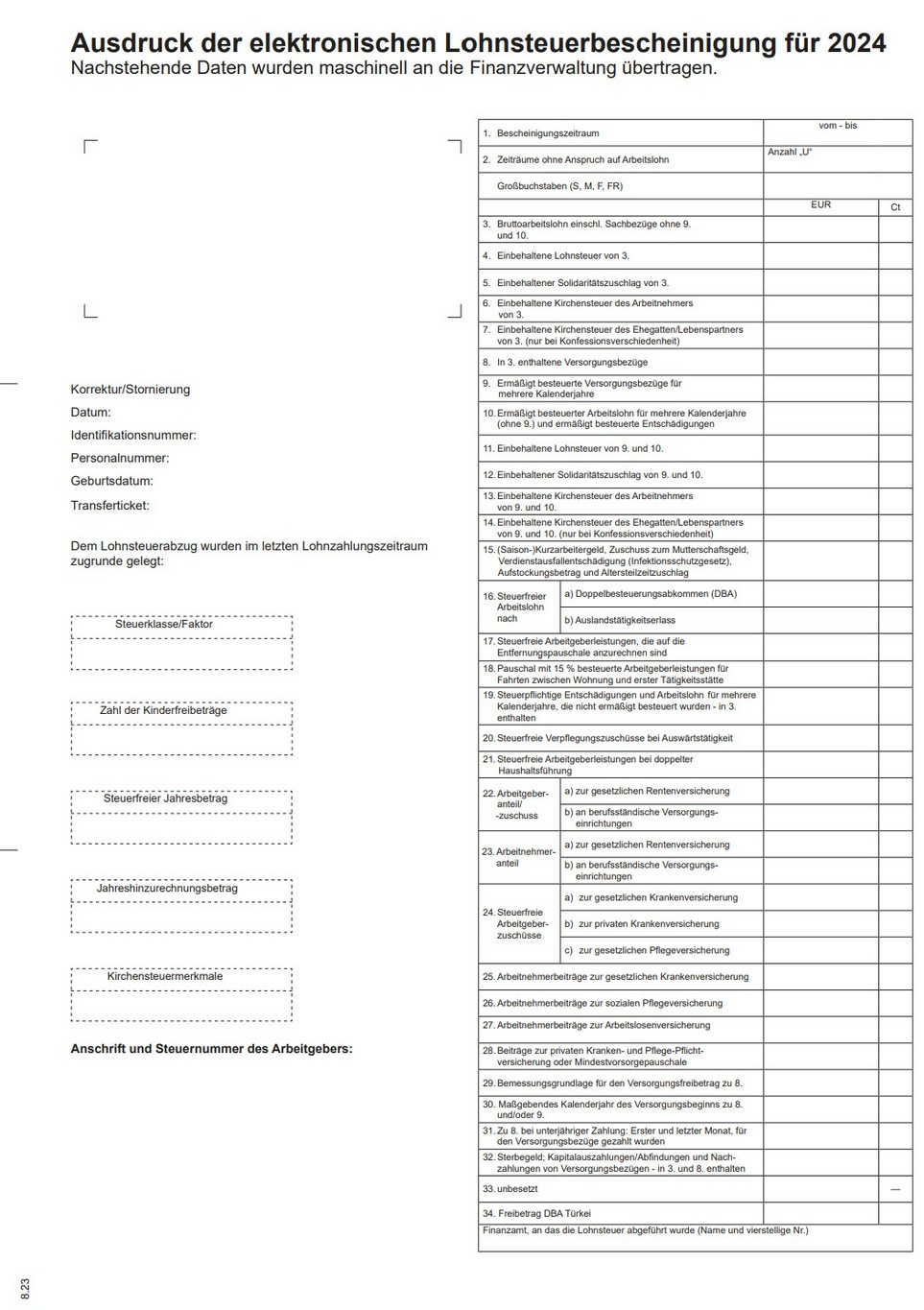

Here you can download the 2024 annual payslip as a PDF.

Which information does an annual payslip in Germany include?

Left column:

Next to your employer’s address and tax number, you will find your wage tax deduction details (Elektronische Lohnsteuerabzugsmerkmale), ELStAM for short. These details are stored at the Federal Central Tax Office (BZSt) and determine the tax amount that is deducted from your income. In 2013, ELStAM replaced paper wage tax statements which lead to the name “electronic wage tax statement.” The details listed include your:

- Name, address, and birthday

- Tax ID (Steuer-Identifikationsnummer)

- eTIN (only up to and including the 2022 income tax statement)

- Personnel number

- Tax class

- Number of child allowances

- Church tax details

- Yearly tax-free allowance (if you applied for allowances for your wage tax deductions)

- Yearly additional income (e.g. if you have several low-paying jobs at the same time)

Right column:

- Duration of employment

- Periods without wages (e.g. parental leave, unpaid leave for at least 5 consecutive working days)

- Taxable gross wages (including taxable benefits in kind)

- Withheld wage tax, church tax, solidarity surcharges

- Contributions to statutory pension insurance and professional pension schemes (berufsständische Versorgungseinrichtung)

- Benefits related to pensions (e.g. retirement pension (Ruhegehalt) or widow’s/widower’s allowances)

- Contributions to statutory or private health insurance (Krankenversicherung)

- Contributions to nursing care insurance (Pflegeversicherung)

- Contributions to unemployment insurance (Arbeitslosenversicherung)

- Wage replacement benefits, e.g. (seasonal) short-term work benefits (Kurzarbeitergeld), unemployment benefits (ALG 1), parental benefits (Elterngeld), maternity benefits (Mutterschaftsgeld), compensation for loss of earnings in accordance with the Infection Protection Act, tax-free top-up amounts, supplements for partial retirement, and tax-free supplements that your employer has provided on top of short-term work benefits

- Tax-free employer benefits (e.g. tax-free allowances for travel expenses or relocation costs in the case of a second household)

- Severance packages (Abfindungen) or bonuses for several years of service – whether they are taxed at once or according to the One-Fifth Method (Fünftelregelung)

Tax Tip: As part of your tax return, the tax office automatically checks whether the one-fifth method for your severance pay is the more tax-efficient option for you (Günstigerprüfung). As of 2025, the one-fifth method will no longer be applied by your employer, but only by the tax office as part of the tax return.

These entries indicate whether you are required to file a tax return

- the capital letter S

- the number 15 (wage replacement benefits)

- a severance package taxed according to the one-fifth method

- tax classes 3/5, 4 with factor procedure, and tax class 6

You can find more information on mandatory tax assessment here.

What do the capital letters under number 2 mean?

- Capital letter F: Tax-free transportation to your first workplace

- Capital letter S: Your employer has calculated the wage tax on a miscellaneous payment (e.g. a Christmas bonus) and hasn’t included the wages from previous employments in the same calendar year

- Capital letter M: If you were provided with meals while working away from home/in a second household, these meals are assessed as benefits in kind

- Capital letters FR: If you are a cross-border commuter who lives in France but works in Germany (e.g. FR2 for employers based in Rhineland-Palatinate)

Can I find my German tax number on my annual payslip?

No. You can, however, find your tax number (Steuernummer) on your last tax assessment notice (Steuerbescheid). If you haven’t yet received your own tax number, it’ll come with your first tax assessment notice.

You can find your tax identification number (Steuer-ID) in the left column of your annual payslip, as it must be used by your employer to transfer your annual payslip to the tax office electronically. Tax-IDs have been issued to all residents in Germnay from the Federal Central Tax Office (Bundeszentralamt für Steuern) since 2008.

What to do in case of incorrect data?

If your annual payslip contains incorrect information, a distinction must first be made:

Incorrect data record with correct wage tax deduction

If the wage tax deduction was correct and only a typo has crept into your annual payslip, then your employer is obligated to correct it according to Section 93c (3) of the Fiscal Code. They must transmit a corrected wage tax statement to both you and the tax office, labeling it as “Korrektur.”

Incorrect wage tax deduction

Your employer is responsible for the correct wage tax deduction (Lohnsteuerabzug) and for the accurate certification and transmission of your wage data to the tax authorities. If they have made errors in the wage tax deduction, they are generally not allowed to retroactively correct the wage tax deduction after submitting the wage tax statement. (Exception: In cases of employee fraud, the employer may claim a reduction in the withheld wage tax (resulting from that fraud) by submitting a corrected wage tax declaration (Lohnsteuer-Anmeldung) to the tax office.)

If employers have withheld too little wage tax, they must report this to the local tax office (§ 41c paragraph 4 EStG). This is called a “liability-exempt notification” and exempts them from being liable for the missing wage tax. The tax office then retrieves the missing wage tax from the employee - either as part of your tax return process or (if you do not submit a tax return) through an wage tax demand notice (Lohnsteuer-Nachforderungsbescheid).

If your employer has withheld too much wage tax, you can only reclaim the money through a tax return!

If the wage tax deduction was incorrect, you are not entitled to have the annual payslip corrected. Because it serves as evidence of the actual wage tax deduction, not the correct wage tax deduction. However, this is not an issue because the annual payslip is not legally binding. Only the tax assessment notice is legally binding.

Amendment of an incorrect tax assessment notice

In case of an incorrect tax assessment notice due to errors in your annual payslip the tax notice can still be amended or revoked. However, we recommend that you always check your payslip data and your e-data in your tax return!

Should I hang on to my Lohnsteuerbescheinigungen?

We recommend that you keep your annual payslips up until you retire. If your pension calculation happens to contain errors, your wage tax statements prove the dates and amount of your wages – this is especially useful if you don’t have social security reports for your entire career. It is best to store all of these documents together along with your tax assessment notice of each calendar year.

Lost your annual payslip?

Employers are required by law to keep their employees' annual payslips for at least 10 years. If you lost or misplaced your wage tax statement, simply request another print out from your employer or former employer. Alternatively, you can request it from your local tax office.