|

Glossary of Tax Terms

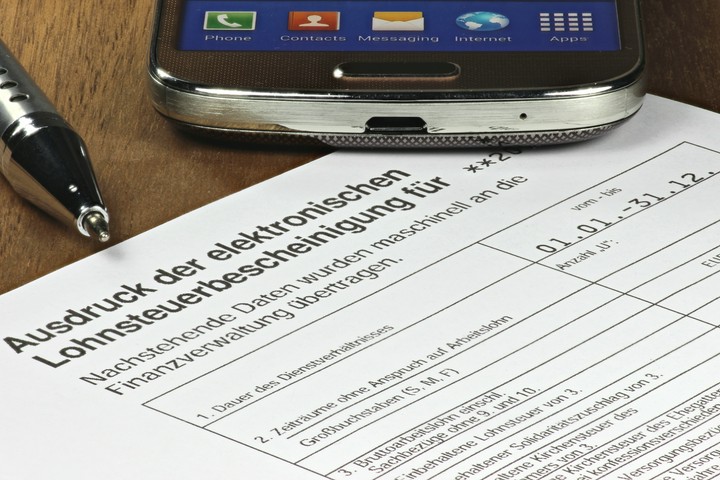

What is a German annual payslip (Lohnsteuerbescheinigung)?

|

Deductible Expenses for Parents

Child benefits (Kindergeld) and child allowances (Kinderfreibetrag)

|

Expenses from Your Profession

Claim Travel Expenses on Your Tax Return

|

Submitting Your Tax Return

Mandatory tax assessment: who has to file a tax return?

|

Submitting Your Tax Return

2024 Tax Changes at a Glance!

|

Submitting Your Tax Return

How to Submit Tax Returns Retroactively

|

Glossary of Tax Terms

Save Taxes with the Income-Related Expenses Lump Sum

|

Submitting Your Tax Return

Lateness penalty fees for overdue tax returns

|

Expenses from Your Profession

This is How the Home Office Lump Sum Works

|

Expenses from Your Profession

How to Deduct Your Work Room at Home from Taxes

|

Glossary of Tax Terms

How rental income is taxed

|

Submitting Your Tax Return

2023 Tax Changes: An Overview

|

Submitting Your Tax Return

5 Tips for Your Tax Return!

|

Glossary of Tax Terms

Tax reliefs 2022: An overview of the tax relief act

|

Expenses from Your Profession

How to Deduct Occupational Disability Insurance from Your Taxes

|

Submitting Your Tax Return

Property Tax Reform 2022: What Owners Should Keep in Mind

|

Glossary of Tax Terms

Deducting Political Party Donations from Your Taxes

|

Deductible Expenses for Parents

Who can claim the 2021 child bonus?

|

Submitting Your Tax Return

Voluntary Tax Returns – Always Worth Your Time!

|

Expenses from Your Profession

Tax Returns for Employees: Deductible Expenses

|

Submitting Your Tax Return

Tax Return 2021: Tips & Tricks!

|

Submitting Your Tax Return

Tax Changes in 2022: Tips for Your 2022 Tax Return

|

Submitting Your Tax Return

Tax return 2020: All tips & tricks for you!

|

Deductible Expenses for Parents

Tax Advantages for Families: A Quick Overview

|

Glossary of Tax Terms

How Top Tax Rates are Handled in Germany

|

Submitting Your Tax Return

Tax Forms for your 2021 Tax Return

|

Glossary of Tax Terms

How to Claim Technical Literature on Your Tax Return

|

Glossary of Tax Terms

Can I Deduct Medications From My Tax Return?

|

Glossary of Tax Terms

Loss Carryforward – How To Reclaim Your Losses

|

Glossary of Tax Terms

The Top 10 Strangest Taxes Worldwide

|

Glossary of Tax Terms

Cryptocurrencies in Your German Tax Return

|

Glossary of Tax Terms

Insolvency Allowance: What is it and how is it taxed?

|

Glossary of Tax Terms

Late Payment Surcharges - Beware of Tax Debt!

|

Submitting Your Tax Return

Deduct Glasses from Your Tax Return

|

Glossary of Tax Terms

Taxing Your Valuable Assets and Investments

|

Glossary of Tax Terms

Double Tax Treaty and the 183-day Rule

|

Glossary of Tax Terms

Maternity Benefits in Germany & How They Affect Your Taxes

|

Tax Assessment Notice

After your tax return: tax back, or tax back payment?

|

Glossary of Tax Terms

How are my retirement funds taxed?

|

Glossary of Tax Terms

How to Claim Tax Allowances on Your Tax Return

|

Submitting Your Tax Return

What is an income tax return?

|

Glossary of Tax Terms

Applying for Wage Tax Reductions

|

Glossary of Tax Terms

Renting and Leasing: An Overview of Deductible Costs

|

Glossary of Tax Terms

Deduct your supplementary dental insurance

|

Short-Term Work (Kurzarbeit): A to Z

Mandatory Tax Assessment due to Short-Term Work

|

Glossary of Tax Terms

Deduct Insurance Costs from Your Taxes