Your eTIN Number

What is my eTIN number and how do I find it?

German bureaucracy is known for being very slow and complicated. The employees themselves aren’t slow, they are simply understaffed. Technical legal jargon also tends to slow down processes as many don’t fully understand what they’re reading and need explanations. For example, let’s look at tax number (Steuernummer), tax ID (Steuer-ID), and eTIN: Do you know the differences between them right off the bat? If so – congrats! But the majority of people have a tough time comprehending the difference between these numbers. We will clarify this in this article, while focusing on the eTIN number.

What is an eTIN number and where can I find it?

The eTIN, short for “electronic taxpayer identification number,” is used by the tax office (Finanzamt) to allocate and organize your tax documents. This primarily concerns your income tax statement (Lohnsteuerbescheinigung) which is transmitted by your employer at the end of each calendar year.

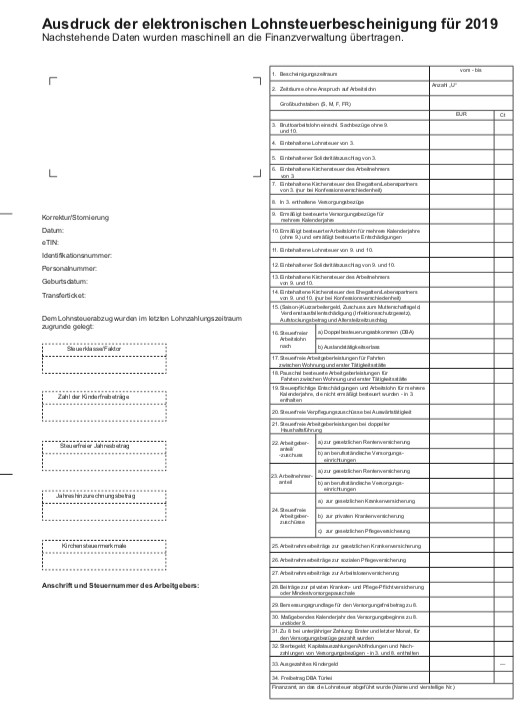

Employees typically receive a print out of their income tax statement from their employer at the end of February, your eTIN can also be found on this statement. This number must often be used when submitting a tax return and is not to be confused with tax IDs which are used for a different purpose.

If your employer uses the official model for income tax statements from the Federal Ministry of Finance (Bundesministeriums für Finanzen), your eTIN will be located on the left side directly underneath the date and above your tax ID.

eTIN auf der Lohnsteuerbescheinigung

Verwendet der Arbeitgeber den amtlichen Muster-Vordruck des Bundesministeriums für Finanzen, dann befindet sich die eTIN auf der linken Seite der Lohnsteuerbescheinigung unter dem Datum und über der Steueridentifikationsnummer.

The difference between eTIN, tax number, and tax ID

eTIN Your employer uses this number to transmit all tax data to the tax office.

Tax number

Anyone who has already filed a tax return has been assigned with a tax number, which consists of 13 digits and is changed each time your local tax office changes (after a move).

Tax ID

Your tax ID can be found on your income tax statement or your tax assessment notice (Steuerbescheid). The sequence of 11 numbers is uniform throughout Germany and is assigned to you permanently, usually directly after birth – the only prerequisite is that you are a resident of Germany.

You can find a more detailed explanation on tax IDs and tax numbers in our article here.