Mistakes Happen – How You Can Withdraw Your Tax Return

Mistakes on your tax return can easily be fixed. We will show you how.

Not everyone is required to file a tax return (Steuererklärung). Even when not required, it is still worthwhile to file a tax return in most cases as you could receive a refund of several hundred euros if your tax return is completed correctly.

Nevertheless, most people are very uncertain and anxious about preparing their first tax return – they wonder what can be included, what happens if they make a mistake, and what if instead of a refund, they end up having to make an additional payment?

There is nothing to worry about – there are tax tools to help you prepare your first tax return and you won’t be punished for incorrect information on your tax return, the information can be corrected afterwards – so you don’t have to worry about an unjustified back payment.

Request for a simple amendment

If you notice that your tax return had incorrect information after receiving your tax assessment notice (Steuerbescheid) from the tax office (Finanzamt), you can correct this by applying for a simple amendment (schlichte Änderung, Section 172 of the tax code) within one month. The points that you mention in your amendment application will be reviewed by the tax office – they can be as simple as entering the wrong address or forgetting to enter semester fees. The tax assessment will only be changed if it is favorable for you.

Appeal

You can file an appeal (Einspruch) if the simple amendment doesn’t suffice, for example, if the tax office didn’t recognize some of your income-related expenses (Werbungskosten). If this is the case, your entire application will be reexamined. You don’t need to provide a reason for your appeal, but you also have no influence over which items will be reexamined.

Withdrawal

If these previous steps have been unsuccessful and you still have to make an additional tax payment, there is a last resort: you can simply withdraw your voluntary tax return and the tax office will then waive the claim.

To put it simply, there is absolutely nothing to lose by submitting a voluntary tax return. If the tax office demands an additional tax payment, you can simply withdraw your application. The only catch is that you have to ensure you complete this within one month – after that, the appeal deadline ends.

Tip: With Wundertax’s tax calculator, you can see whether you can expect an additional payment even before submitting your tax return. Any errors can then be corrected right away and you can save yourself the trouble of making an appeal to the tax office.

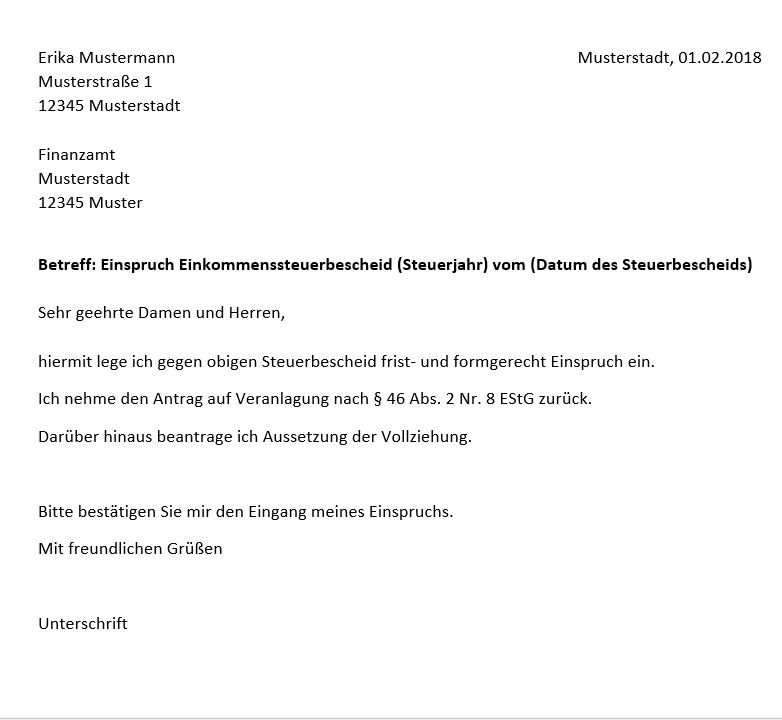

Sample Appeal Letter

Below you will find a sample letter (in German) in case you would like to make an appeal to the tax office. Although the letter must be submitted in German, here is the English translation so that you can understand exactly what is stated in the letter:

Firstname Lastname Street Name 1 12345 City

City, 01.02.2021

Subject: Appeal against (YEAR) Tax Assessment Notice from (DATE)

To whom it may concern,

I hereby file an appeal against the above tax assessment notice in due time and form.

I would like to withdraw my application for assessment according to § 45 Paragraph 2 No. 8 of the Income Tax Law.

In addition, I request that you do not finish processing my application.

Please confirm that you have received my appeal.

Best regards, Signature