Clarify Tax Matters with an Informal Request (Formloser Antrag)

What are these criteria?

In an informal application (formloser Antrag), one could assume that the letter can look unofficial since it does not have to comply with a certain standard. Well, this is a wrong thought: formless applications cannot be presented arbitrarily; some criteria must nevertheless be met. So what are these criteria? Read on to find out.

What is an informal application (formloser Antrag)?

As the name implies, an informal application is the opposite of a formal application (formaler Antrag). If the form needs to be preserved in a formal letter, an informal application does not follow a specific layout. The form of writing, as well as the content, can be chosen freely. The aim is to avoid bureaucracy and to express its concerns in an uncomplicated manner.

When does an informal application apply?

An informal application can be used in different scenarios. For example, if you want to check or correct a specific point in your tax return, you can do so by means of an informal application. An informal application does not only apply to authorities but also banks, universities, companies, and cooperations. Basically, no formal guidelines have to be complied with. It is, however, important to present the content clearly and precisely.

Writing an informal application (Formloser Antrag)

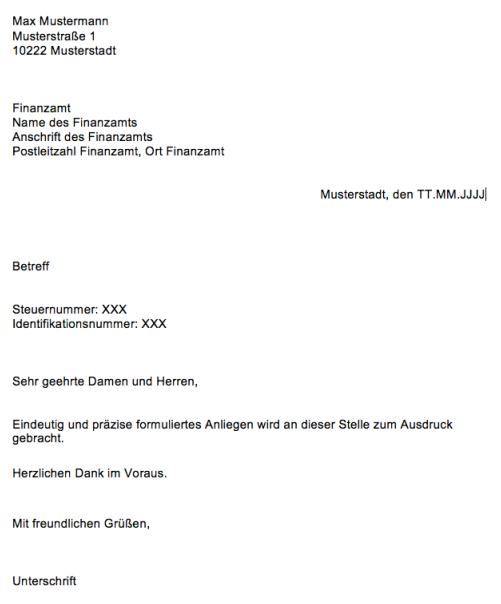

The power of habit also affects an informal request. The rule of thumb is to use a white paper. With patterned or coloured paper, a serious issue is not given the consideration it deserves.

As with a formal letter, the application should include a place, a date and, at the end, signed off with a handwritten signature. Usually, the address of the sender, as well as that of the recipient, are indicated. Also, a clearly formulated subject should be indicted in the application. This way, the informal application can be better addressed and, at best, save a lot of time.

Anyone who writes to his/her tax office should also specify the personal data (Steueridentifikationsnummer, if available Steuernummer, etc.). Last but not least, a proper salutation must be included as it expresses respect and courtesy.

Offices rarely work with informal applications (Formloser Antrag)

Tax offices are overwhelmed with a lot of applications every day. These are usually specified applications that have a specific form. In most cases, these are layouts have blank spaces that only need to be filled out by the applicant. These spaces often require some personal details about the applicant. Take the example of advertising costs (Werbungskosten). Anyone wishing to claim income tax expenses as part of the tax return must enter the expenses in the designated form fields. The tax office then takes from them what the applicant wants to deduct from the tax. Of course, there are numerous other applications (Kindergeld, Arbeitslosengeld etc.) that are form-bound and must be forwarded to the tax office accordingly.

However, if it is not a matter of deducting expenses, but only of describing a situation quickly and easily, an informal application can be used.