Tax Study (Steuerstudie): How High Is the Average Tax Burden?

A recent tax study by Wundertax and the Humboldt University of Berlin shows that tax burdens are overestimated, especially for low and middle incomes.

Tax Study: How high is the Average Tax Burden (Steuerbelastung)?

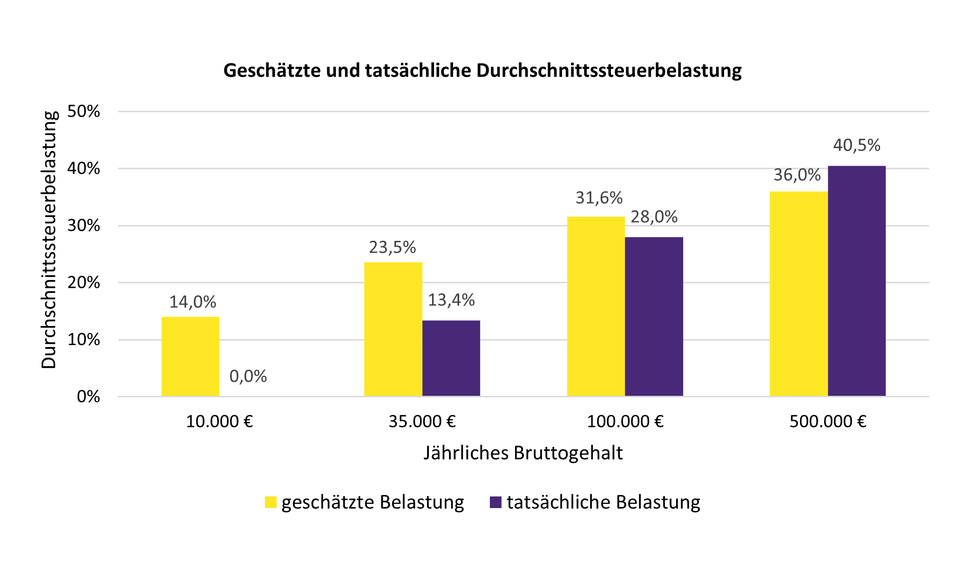

If you don’t know how much income tax you pay, don’t worry - about a quarter of the participants in our 2020 tax study, which Wundertax conducted in cooperation with the Humboldt University of Berlin, didn’t know either. In the study on “Perception of Income Tax Burden”, 517 study participants were asked about their own tax burden and to estimate the income tax for employees (unmarried, childless, without other income) with annual gross salaries of 10,000, 35,000, 100,000 and 500,000 euros. They were asked to estimate both the average tax burden (Durchschnittssteuerbelastung) and the tax limit burden (Grenzsteuerbelastung) for these salaries.

Wait a minute - what is average tax rate (Durchschnittssteuersatz)? And what about tax rate limit (Grenzsteuersatz)?

Taxes affect all of us - but it is often difficult to understand tax jargon. Let us explain: Your average tax rate is the percentage of income tax that you pay on your total taxable income. You can calculate your average tax rate by dividing the amount of tax you’ve paid by your taxable income. Multiply the result by 100 to get your average tax rate.

Example: On a taxable income of 48,000 euros, a tax amount of 11,107 euros is due (without solidarity surcharge (Solidaritätszuschlag)). 11,107 euros / 48,000 euros = 0.231 × 100 % = 23.1%.

Usually more than one single tax rate is applied to your annual income. If you have high income, several tax rates can be applied, which is why there is a tax rate limit (Grenzsteuersatz). In German tax law there are 5 tax zones - Zones 2 and 3 (income between 9,744 and 57,919 euros as of 2021) are divided into income brackets (Einkommensstufen) and a fixed tax rate limit is applied to each one according to the respective tax rate limit. The sum of this is your payable tax. Tax rates are progressive, meaning the more you earn, the higher the tax rate. The idea behind this is “tax justice,” Which brings us back to our study.

Misperception of Tax Burdens

Most study participants greatly overestimated the average tax burden, especially for the first two salary groups. For an annual income of 10,000 euros, an average tax rate of 14% was assumed, whereas the actual burden is actually 0.

Those with a 10,000 euro annual salary aren’t required to pay tax, therefore there is no tax rate. The Basic Tax-Free Allowance (Grundfreibetrag), on which no one has to pay taxes, amounts to 9,744 euros (2021) and in addition, there is a lump sum of 1,000 euros for income-related expenses (Werbungskostenpauschale), which is automatically deducted from your income. Only what you earn above this amount is taxed.

A 13.4% tax rate is applied to annual salaries of 35,000 euros - contrary to that, many study participants estimated the average tax rate for this income to be just under 24%, almost twice as high as it is in reality.

The tax rate is overestimated by 3.6 percentage points for an annual salary of 100,000 euros. The average tax burden for an annual salary of 500,000 euros, on the other hand, is underestimated: in fact, 4.5% more tax is due on this than the participants thought.

23% of the participants couldn’t answer about their own tax burden - they simply didn’t know. The vast majority overestimated their own tax burden even more than they overestimated the given gross salaries.

All participants found it even more difficult to estimate the tax limit burden (Grenzsteuerbelastung) than the average tax burden (Durchschnittsststeuerbelastung), both for their own salary and for the given income groups.

At What Point Do You Become a Top Earner in Germany?

Would you have thought that with an annual salary of 55,000 euros you already belong to the top 10% earners in Germany? The top tax rate (Spitzensteuersatz) of 42% applies to incomes higher than 57,918 euros per year (2021). The gap between the “normal” and the “top ten” is not as wide as one might think.

Those with an annual income of more than 133,500 euros are part of the top 1 % of earners in Germany. Half of the participants thought that this was only possible with an annual salary of 500,000 euros.

Tax Cut (Steuersenkung)

When asked what tax burden they felt was appropriate, 60% of participants were in favour of a tax cut for all 4 salary groups, even those with incomes exceeding 500,000 per year (based on their previous [mis]assessment). It is also interesting that the tax burden perceived as appropriate for incomes of 10,000 euros and 35,000 euros is still higher than the actual tax burden.

Subjective Perception…

The study illustrates the subjective perception of tax burdens, which is perceived as too high in all 4 salary groups without differentiation. However, this perception is based on false assumptions.

It may be that these difficulties stem from the fact that knowledge about tax rate limits and tax progression (Steuerprogression, see above) is hardly available. Our progressive tax system redistributes income primarily from the upper middle class and higher earners downwards. This is supposed to alleviate the unequal distribution of income and ensure more justice. A serious discussion on property tax (Vermögenssteuer) and inheritance tax (Erbschaftssteuer) could also be worthwhile.

… Actual Tax Burdens

Your “taxable income” is not the same as your gross salary! It is the amount on which taxes are due after all deductible expenses have been deducted. This makes it even more important to file a tax return!

For example, the lump sum for income-related expenses (Werbungskostenpauschale) of 1,000 euros per year is already taken into account on a pro-rata basis in your monthly wage tax deduction. If you haven’t worked all year, you won’t use the Employee Lump Sum (Arbeitnehmer-Pauschbetrag) to its full potential, but you have legal claim to its full amount - Even if your actual income-related expenses are lower, you received wage replacement benefits, or didn’t work the entire year. You can only claim your entitlement to this lump sum by - you guessed it - filing a tax return.

The tax authorities have already increased some allowances for the tax years of 2020 and 2021 (Basic Tax-Free Allowance, child allowance & child benefits, relief amount for single parents). They also introduced the new Home Office Lump Sum and abolished the solidarity surcharge for 90% of taxpayers. You can find detailed information on these tax reliefs in our article Tax Return 2021 - take advantage of these to save taxes!

“Ignorance of the tax laws does not exempt you from paying taxes. Knowledge, however, often does!" (A. Meyer Rothschild, banker)

File your tax return now with the low-cost online tool from Wundertax!

Many thanks to Prof. Dr. Ralf Maiterth and M. Sc. Karina-Bettina Körösi - Chair of Business Taxation - Faculty of Economics - Humboldt University of Berlin