Request for simple change: When Mistakes are on Your Tax Return

It isn't uncommon for inconsistencies to creep in here as well.

Appeal (Einspruch) vs. a request for a simple change (Antrag auf schlichte Änderung)

There are two ways to appeal a tax assessment notice (Steuerbescheid) in Germany. On the one hand, in the case of non-recognition of certain items, it is possible to file an appeal (Einspruch), but on the other hand, a request for a simple change (Antrag auf schlichte Änderung) suffices often. Now, we will explain the consequences of various options.

Consequences of an appeal (Einspruch)

If an appeal is filed, it has the following consequences:

- the tax office rechecks all information - mistakes that have been made in your favor will also be corrected

- if the tax office discovers errors that lead to additional payments, they will threaten you with a “penalty fee” (in this case, the appeal can be withdrawn, the incorrect tax assessment remains then untouched and becomes valid)

What is a request for a simple change (Antrag auf schlichte Änderung)?

The legal basis for a request for a simple change (Antrag auf schlichte Änderung) is in §172 of the Tax Code (Abgabenordnung). Compared to the appeal (Einspruch), the petition seeks only to correct certain items in the tax return (Steuererklärung). As a result, only facts noted in the cover letter are re-examined. Other negative consequences (such as reformatio in peius against an appeal) are excluded in this variant.

Appeal (Einspruch) and amendment (Antrag auf schlichte Änderung) in comparison

in an appeal (Einspruch)

- Tax case is completely re-examined

- auditing may lead to reformatio in peius

- until then, an established tax assessment (Steuerbescheid) is not valid

- there is no need to state why the decision should be reviewed again

in case of an amendment (Antrag auf schlichte Änderung):

- only selective auditing

- The tax assessment (Steuerbescheid) may only be changed in favor of the taxpayer

- Deadline is 1 month, as with an appeal

- Amendment has to be formulated in concrete terms (it must be pointed out which items should be assessed)

Reasons for an amendment (Antrag auf schlichte Änderung)

There are situations where a change request (Antrag auf schlichte Änderung) is worth it.

For example, these are

- The tax assessment (Steuerbescheid) contains formal errors such as the wrong address

- The facts were not clearly described

- Taxpayers forgot to indicate expenses or costs

- Advertising costs (Werbungskosten) were not recognized

- only a specific item should be changed, but not the entire tax assessment

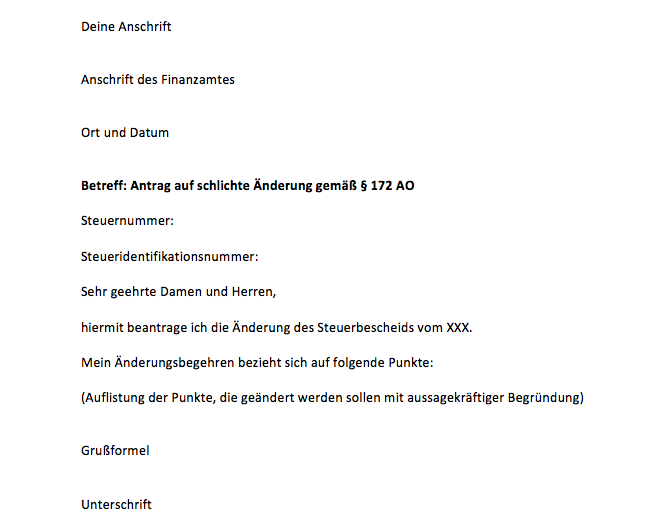

What does an amendment (Antrag auf schlichte Änderung) look like?

Amendments (Antrag auf schlichte Änderung) are not subject to any specific form. This means that the application can be submitted informally. Compared to an appeal (Einspruch), you can simply initiate the simple change by phone or by personal interview. In any case, it is important to clearly state what exactly should be changed for all variants. Sometimes, it can happen that the tax office (Finanzamt) requires additional evidence from you depending on the circumstances.

Tip: To be on the safe side, we recommend submitting the change request in writing. This then contains all the essential items and requests a correction at the same time.