Deducting Political Party Donations from Your Taxes

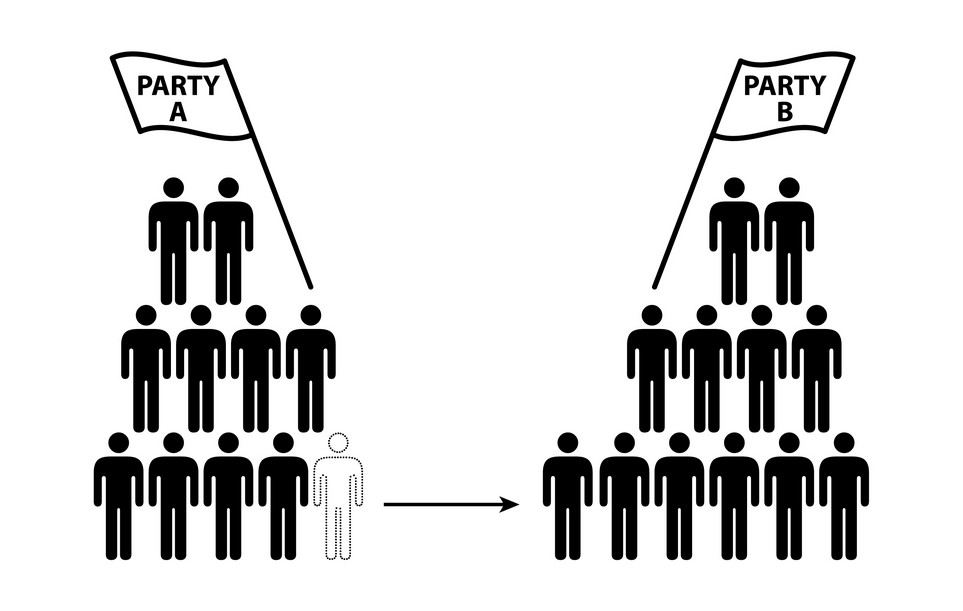

Donations or membership fees made to political parties can be claimed on your tax return. Learn more in this article.

Members of political parties pay membership fees that vary depending on their income. Another common way to fund political parties comes from donations. Both donations and membership fees can be claimed on your tax return, how these are regulated by the income tax law (EStG) and what requirements must be met will be covered in this article.

Donations to political parties (Parteispenden)

Donations to political parties can reduce your tax liability as German tax laws classify these donations as special expenses (Sonderausgaben). Other donations (such as donations to charity, church, etc.) are also deductible amounting up to 20% of your income, however, donations to political parties are handled slightly differently and separate rules apply.

There are two possible ways for the tax office to handle political party donations, they will first resort to option one, and if higher donations remain, they will then resort to option two:

1. Income tax reduction (Ermäßigung der Einkommensteuer)

Your tax liability is directly reduced by 50% of your donation amount for donations/fees up to 1,650 euros for single persons and 3,300 euros for married couples filing a joint assessment. For example, if you donate 1,650 euros, you automatically pay 825 euros less in taxes. These costs can be entered in the Special Expenses Form on your tax return.

2. Special expenses (Sonderausgaben)

Donations and membership fees for political parties that exceed the maximum amount are also treated as special expenses. Instead of being directly deducted from your tax liability, they are deducted from your taxable income and can directly reduce your tax rate (Steuersatz). The amount of tax savings that you receive from this depend on your individual tax rate.

When considering both of these options, you can receive tax benefits from up to 3,000 euros per year (or 6,600 if jointly assessed) in donations and membership fees for political parties.

For example, a single person who donates 3,000 euros to a political party would initially have their tax liability reduced by 825 euros (half of 1,650) and can then declare the remaining 1,350 euros (3,000 - 1,650 = 1,350) as special expenses to potentially reduce their tax rate. This means of the 3,000 euros in party donations, 2,175 are directly tax-deductible.

Important tips at a glance

- 50% of donations and membership fees to political parties up to 1,650 euros (married couples: 3,000 euros) are directly deducted from your income tax liability.

- Donations and membership fees that go over this amount are deducted from your taxable income as special expenses (max 1,650 for singles and 3,300 for married couples completing a joint assessment).

- Donation payments must be proven to claim them on your tax return. Donations up to 200 euros (300 euros as of 2021) can be proven with a bank statement as a simplified proof of donation.

- If you are enrolled in online banking, an online account statement is sufficient as proof (including the name and account number of the donor and recipient, the amount transferred, and the posting date).

- Membership fees must also be proven with a receipt to claim them on your tax return.

- Donations to political parties from natural persons are subsidized by the state with 0.45 euros for each donated euro.

What other donations can be claimed on my tax return?

According to Section 10b paragraph 1 of the German Income Tax Act (EStG), tax-privileged organizations are legal entities under public law (e.g. city and municipal administrations, churches, universities), public offices (e.g. state museums, state theaters), and/or non-profit associations, charity organizations, and charity foundations. Donations for these purposes amounting up to 20 percent of your total annual income can be claimed on your tax return as special expenses.

Donations are deductible as special expenses if they meet the following circumstances:

- They are voluntary

- They are made free of charge to tax-privileged organizations

- They serve to promote tax-privileged purposes

- They can be proven with donation receipts (§10b Paragraph 1 EStG) (applies to donations over 300 euros as of 2021)

Those who pay into the assets of tax-privileged foundations can deduct up to 1 million euros every ten years (2 million for joint assessment). These deductions can be spread out throughout the decade as you wish and specifically could be used in years with particularly high tax burdens.

Some additional information on deducting donations..

- Companies cannot deduct an unlimited amount of donations. Donations amounting up to 20% of their yearly sales are tax-deductible.

- Direct contributions to people in need don’t count as donations. If you regularly support someone on a permanent basis, these expenses can be claimed as extraordinary expenses (außergewöhnliche Belastungen) on your tax return.

- Donations to any corporation that pursues charitable purposes can be claimed as special expenses.

Have you made donations to political parties? Save taxes and file now!