How do I file an appeal against the tax notice? (Einspruch gegen Steuerbescheid einlegen)

The only thing that comes into question for many people is to file an appeal.

If you have filled out your tax declaration correctly, you can usually look forward to a hefty repayment. The waiting period until receipt of the tax notification is often sweetened with a long vacation or intensive shopping. Why not? Money will come back soon. And then it happens suddenly. The tax office tells you that you get much less refund than you expected. For many then only an appeal (Einspruch) comes into question.

Reasons for an appeal (Einspruch)

The reasons for filing an appeal can be very different. Common to all is that a taxpayer usually feels disadvantaged. Sometimes, however, just essential information was forgotten.

Following reasons can justify an appeal:

- Deductible expenses were not stated in the tax return

- Costs for household-related services (haushaltsnahe Dienstleistungen) were not recognized

- The tax office has miscalculated

- Deductible expenses costs were rejected

- Exceptional costs (außergewöhnliche Belastungen) were not included

- Taxpayer-friendly judgments and administrative instructions were disregarded

Note: How the tax office (Finanzamt) came to its calculation, you can read in the “Erläuterung der Festsetzung”. This is under the calculation of the tax office. If the text has not been formulated unambiguously, a call to the responsable clerk may be worthwhile.

Worth knowning on filing an appeal

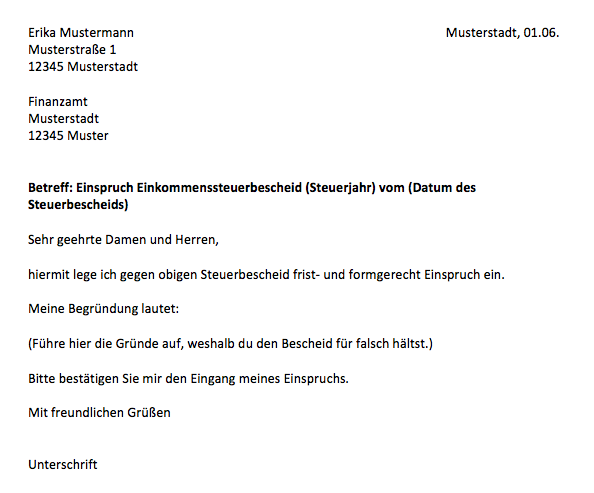

After receiving the tax assesment, you have 1 month to file an appeal. In order to do this, an informal letter that shows the tax office, even without mentioning any reasons, that an objection has been made is sufficient. This letter can also be withdrawn at any time without fear of consequences.

Tip: If only a specific part of the tax notice (Steuerbescheid) is to be rechecked, it is advisable to apply for a simple change (Antrag auf schlichte Änderung).

Legal information

Appeals must always be made in writing. This is governed by Paragraph 357 (1) AO (Abgabenordnung). It must be possible to deduce from the letter who lodges an appeal. For this, the name and address must be written down. In principle, the document does not even have to be signed.

Whether the objection is sent by e-mail, fax or classic by post is not important. Tax Offices allow the transmission by electronic means, if the recipient offers this possibility also expressly. In order to be able to prove the date of the dispatch in a dispute, e-mails should be avoided. It is best to send an objection by mail or fax.

What happens after the appeal?

After the tax office has received the appeal, the entire tax declaration is re-examined. In principle, the objection must first of course be admissible. For even objections that are unfounded in the matter can be rejected.

The responsable tax clerk can make the following decisions:

- Remedy (Abhilfe): justification of the applicant is accepted

- Partial remedy (Teilabhilfe): justification is only partially accepted

- Opposition decision (Einspruchsentscheidung): appeal rejected

If the appeal is rejected, the only option is to go to the tax court and file a lawsuit.