How to read your tax assessment notice (Steuerbescheid Aufbau)

This article seeks to review the topic more closely.

Waiting can really get into your nerve. The worst part is that in most cases, you don’t even have an influence on the waiting time. The fact that some matters are so important also makes it hard for anyone to be patient.

Before you can hold your tax assessment notice in your hands, you might have to wait for several weeks without even hearing anything from the tax office. During this time, you will not find anyone to answer the question troubling your mind more than anything else: How much do I get back from the state? To get the answers you want, you need to review your tax assessment notice because it provides such information and more. This article seeks to review the topic more closely.

Certainty thanks to tax assessment notice (Steuerbescheid)

After sending your tax return to the tax office, you have to wait for weeks before receiving your tax assessment notice. Even after receiving it, there is still a lot that you need to do to ensure it is accurate. This is because any tax expert will advise you to check the letter thoroughly and make sure that all the information contained therein is correct. It is also imperative to note that you can only appeal against possible mistakes within one month of receiving the report.

As a rule, tax offices send the notices about 6 to 8 weeks after receiving the income tax return. This duration can be longer or shorter sometimes depending on a number of factors. Primarily, however, the time you wait for your tax assessment notice depends on whether the office is working to beat a deadline. At this time, of course, the workload that the caseworker needs to clear is significantly higher. Additionally, more delays are likely to occur at this time as compared to when there are no deadlines approaching.

In fact, it is estimated that every 5th to 7th tax assessment contains errors. Receiving an erroneous report, therefore, does not necessarily imply that you sent a faulty return to the tax office. To save your money, you must review your tax assessment notice and ensure that it is free of errors.

Structure of tax assessment notices (Aufbau Steuerbescheid)

The primary structure of a tax assessment is largely the same. To begin with, the letter must provide information on whether the assessment is provisional or it is the final tax assessment.

The provisional report (Vorläufigkeitsvermerk) is usually prepared if no corresponding court decision has been announced with respect to a tax law issue. Once a judgement has been pronounced, the provisional assessment becomes the final one. In some cases, a new tax bill with the current case law is then sent to the taxpayer.

After the verdict has been pronounced, the tax liability of each citizen is listed. This is usually determined by the tax office. The tax liability is then divided into income tax, solidarity surcharge and, if applicable, church tax.

After confirming if the assessment is final or provisional, it is important to ensure that it captures your personal details correctly. For instance, make sure that your bank details are correct because any repayment has to be transferred to the correct account.

The last section, the “Explanatory Notes” (Erläuterungen), explains how the tax office came to its decision. Here, the taxpayer finds the expenditures, entries, or lump sums that were not recognised. The section also explains why such items were not recognised in an understandable or detailed manner. Moreover, an instruction on legal remedies is given here, which provides information on when and how an appeal against the tax assessment can be filed.

Objection (Einspruch Steuerbescheid)

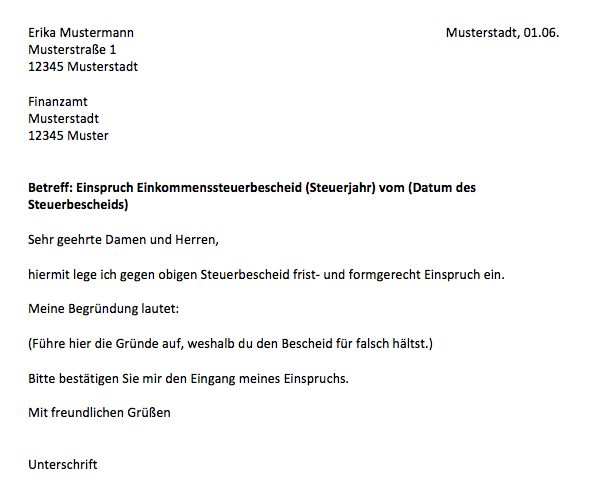

Note that you can file an assessment objection within one month of receiving it. All you need to do is write a formal letter that shows the tax office that an objection has been made. Where possible, however, make sure to mention the grounds of your objections

Change request (Änderungsantrag Steuerbescheid)

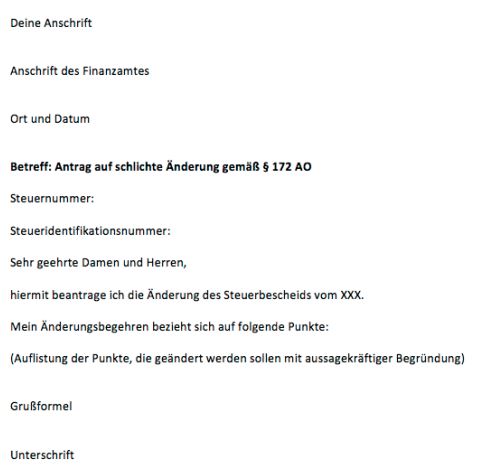

If only a certain part of the tax bill is to be re-examined, however, it is advisable to apply for a simple change instead of objecting the entire assessment.